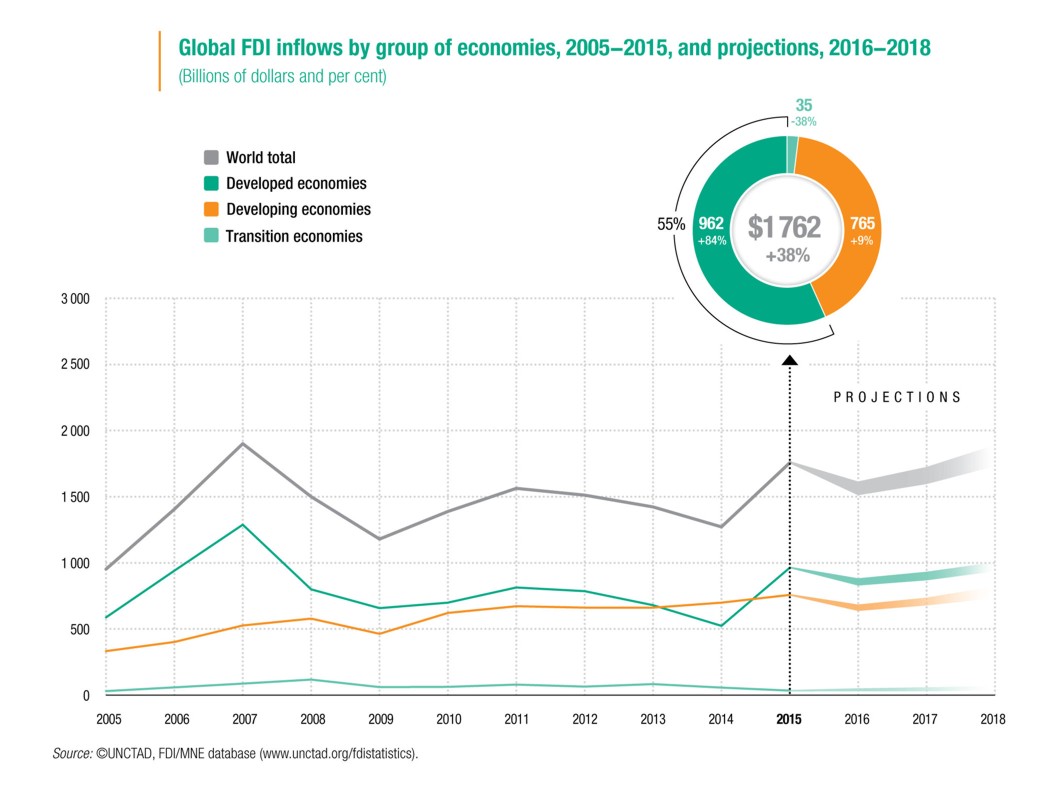

Recovery in FDI was strong in 2015, according to UNCTAD Report. Global foreign direct investment (FDI) flows reached their highest level since the global economic and financial crisis of 2008–2009, to $1.76 trillion, which is jump by 38 per cent. The principal factor behind the global rebound was a surge in cross-border mergers and acquisitions (M&As) to $721 billion, from $432 billion in 2014. The value of announced greenfield investment remained at a high level, at $766 billion.

Part of the growth in FDI was due to corporate reconfigurations. These transactions often involve large movements in the balance of payments but little change in actual operations. Discounting these large-scale corporate reconfigurations implies a more moderate increase of around 15 per cent in global FDI flows.

The fDi Report 2016 published by The Financial Times, as main focus measure the announced greenfield FDI projects. As stated in this Report the biggest change in greenfield FDI in 2015 was the near tripling of greenfield FDI into India, with an estimated $63bn, and for the first time the leading country in the world for FDI, overtaking the US and China.

The rapid growth of greenfield FDI in India shows that, FDI is strongly attracted to high-growth economies and that to attract high volumes of FDI, locations need to create the conditions for strong economic growth and development to take place.

Republic of Serbia Government together with all Government institutions the last few years especially built strong conditions and regulatory environment for economic growth and development. The results are already visible - in 2015 Serbia was the only destination country in the SEE region with announced greenfield FDI projects and it is expected that Serbia will be the leading country in the region development in the coming years.

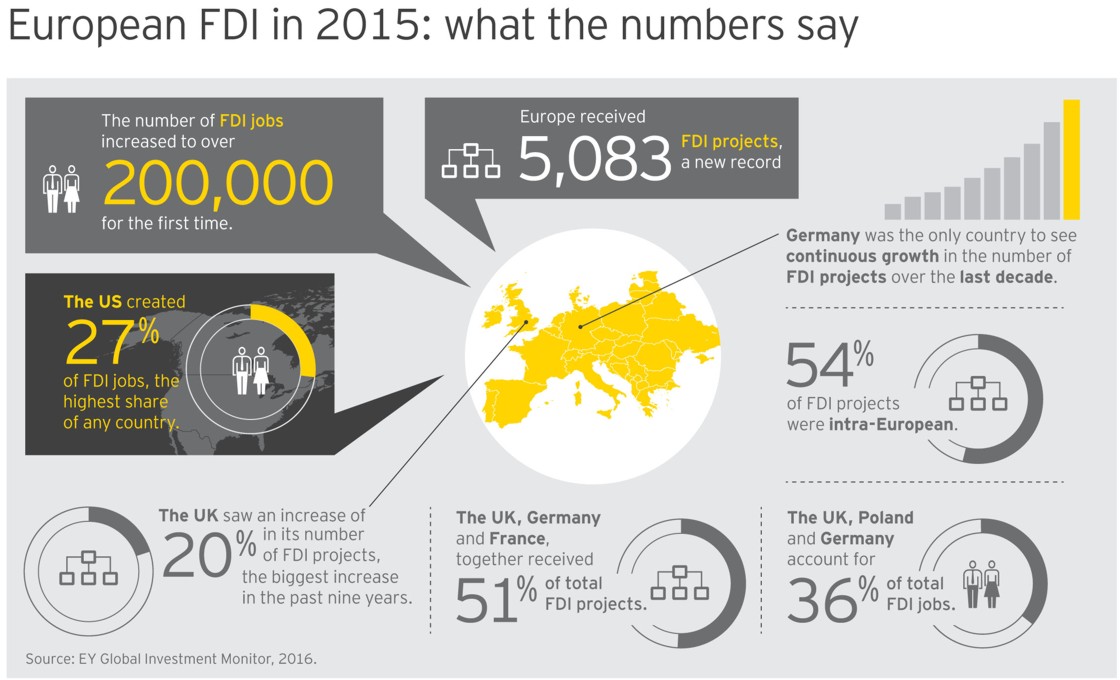

Despite an uncertain business environment and a number of geopolitical risks, investors continue to see the Europe region as an attractive destination. Europe’s strengths are its digital and logistics infrastructure, skilled labor force and stable political, legal and regulatory environments.

Capital investment into Serbia grew by 90%, helping the country break into the top 10 destination countries in Europe, according to fDiIntelligence (a specialist division of The Financial Times Ltd) report 2016.

Manufacturing, and finance and business services remain the drivers of FDI with growth focused in the CEE region. Hungary (69 projects, up 103%), Poland (117 projects, up 34%), Turkey (105 projects, up 52%), Serbia (51 projects, up 76%) and Romania (51 projects, up 21%) drove FDI in manufacturing facilities (EY’s Attractiveness survey Europe 2016).

As far as jobs are concerned, Central and Eastern Europe (CEE) saw the creation of 50% of all FDI jobs in Europe, thanks to the strength of the region in manufacturing, which accounted for 69% of the FDI projects in the region. Serbia achieved 10,631 jobs created in 2015 (108% change from 2014) which puts it on Top 10 countries by FDI job creation list (EY’s Attractiveness survey Europe 2016).

FDi European cities and regions of the future 2016/2017 rankings, published by The Financial Times says Belgrade, Serbia is in top 10 large European cities of the future 2016/2017 – cost effectiveness. In category small and micro European cities, 4 towns more from Serbia are winners for cost effectiveness and economic potential (Sremska Mitrovica, Sombor, Vranje, Zajecar).